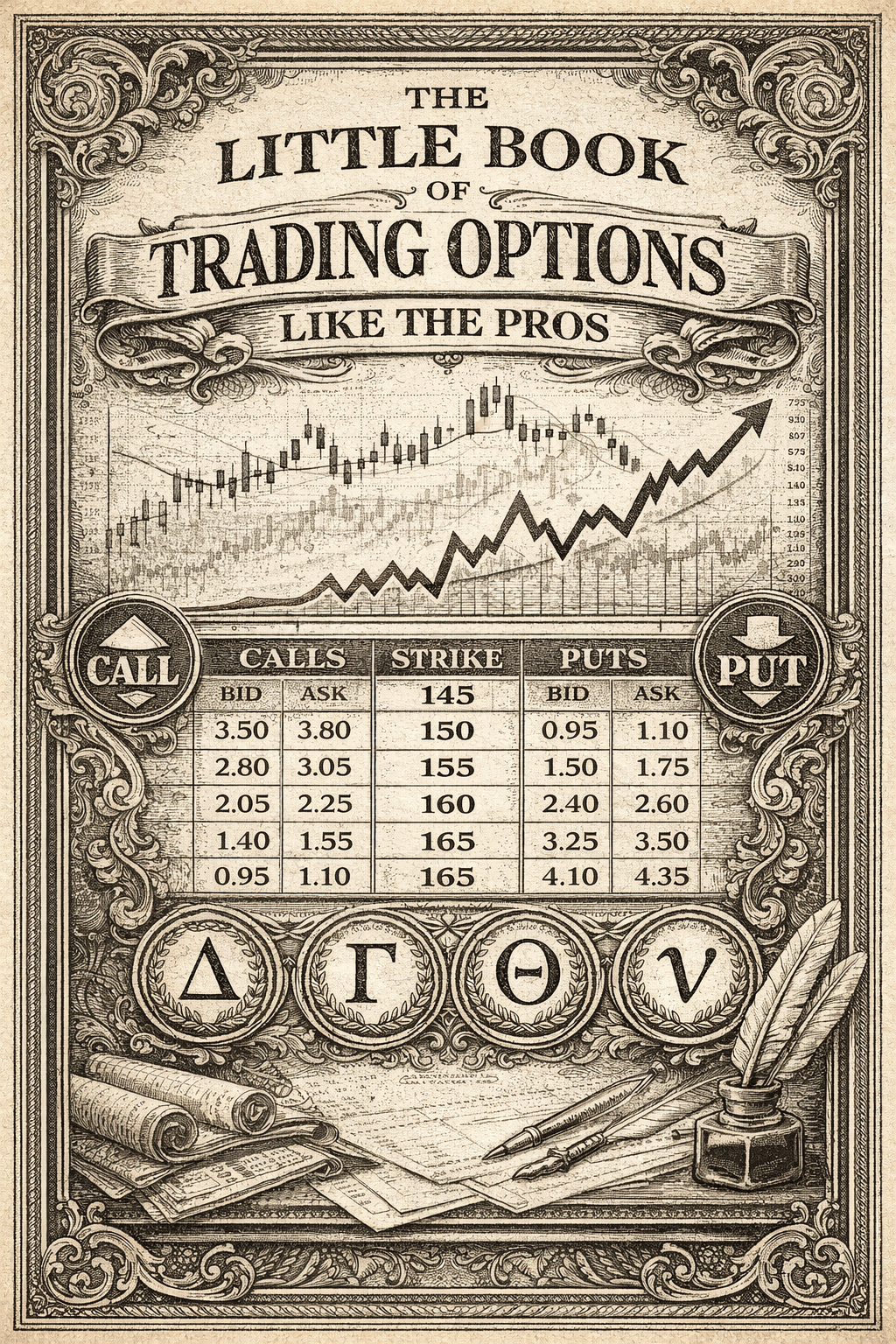

The Little Book of Trading: Options Like the Pros - A Practical Guide to Options Trading

Most options trading books are either too academic or too simplistic. This little book strikes a rare balance. Practical enough to implement immediately, deep enough to avoid rookie mistakes. If you're tired of losing money on options or just want to understand what the hell a 'put credit spread' actually means, this is your starting point.

Trading Options Without Losing Your Shirt (Or Your Mind)

Introduction: Finally, an Options Book That Doesn't Insult Your Intelligence

I've read my share of options trading books. Most fall into two categories: textbook-dry mathematical treatises that assume you have a PhD in quantitative finance, or get-rich-quick schemes written by people who made more money selling books than trading options.

The Little Book of Trading: Options Like the Pros is refreshingly different. It's written by someone who clearly trades options for a living and isn't trying to sell you a $5,000 "mentorship program." The tone is practical, the strategies are battle-tested, and the risk warnings are prominent and honest.

I picked this up partly because of its compact size (almost pocket-sized) which made it perfect for reading on planes and during travels. Sometimes the best learning happens in those stolen moments between destinations, and this book's concise format delivered exactly what I needed without the usual textbook bloat.

What makes this book valuable:

No Fluff: At ~200 pages, it's mercifully concise. Every chapter delivers actionable strategies without padding.

Real Risk Management: The book spends serious time on position sizing, stop losses, and what to do when trades go wrong. Because they will.

Strategy Progression: Starts with basics (calls and puts) and builds to more sophisticated spreads and combinations. Logical learning curve.

Honest About Difficulty: The author doesn't pretend options trading is easy money. It's complex, risky, and requires discipline.

For those interested in income generation through options, understanding market mechanics beyond buy-and-hold, or adding sophisticated tools to your investing toolkit, this is a solid foundation. (Buy on Amazon)

Book Details at a Glance

| Feature | Details |

|---|---|

| Title | The Little Book of Trading: Options Like the Pros |

| Author | Michael C. Thomsett |

| Publication Year | 2018 |

| Genre | Finance, Investing, Trading Strategy |

| Length | ~208 pages (quick read) |

| Main Themes | Options strategies, Risk management, Income generation, Market timing |

| Key Concept | Options as tools for strategic risk-reward positioning, not gambling |

| Relevance Today | Essential for modern portfolio management, volatility trading, income strategies |

| Readability | Clear, practical, assumes basic market knowledge but explains concepts well |

| Who Should Read? | Intermediate investors, active traders, anyone wanting income beyond dividends |

Breaking Down the Book: Key Strategies & Insights

The book's structure is refreshingly logical: it builds from foundational concepts to increasingly sophisticated strategies. The author assumes you understand basic stock trading but doesn't assume you know anything about options.

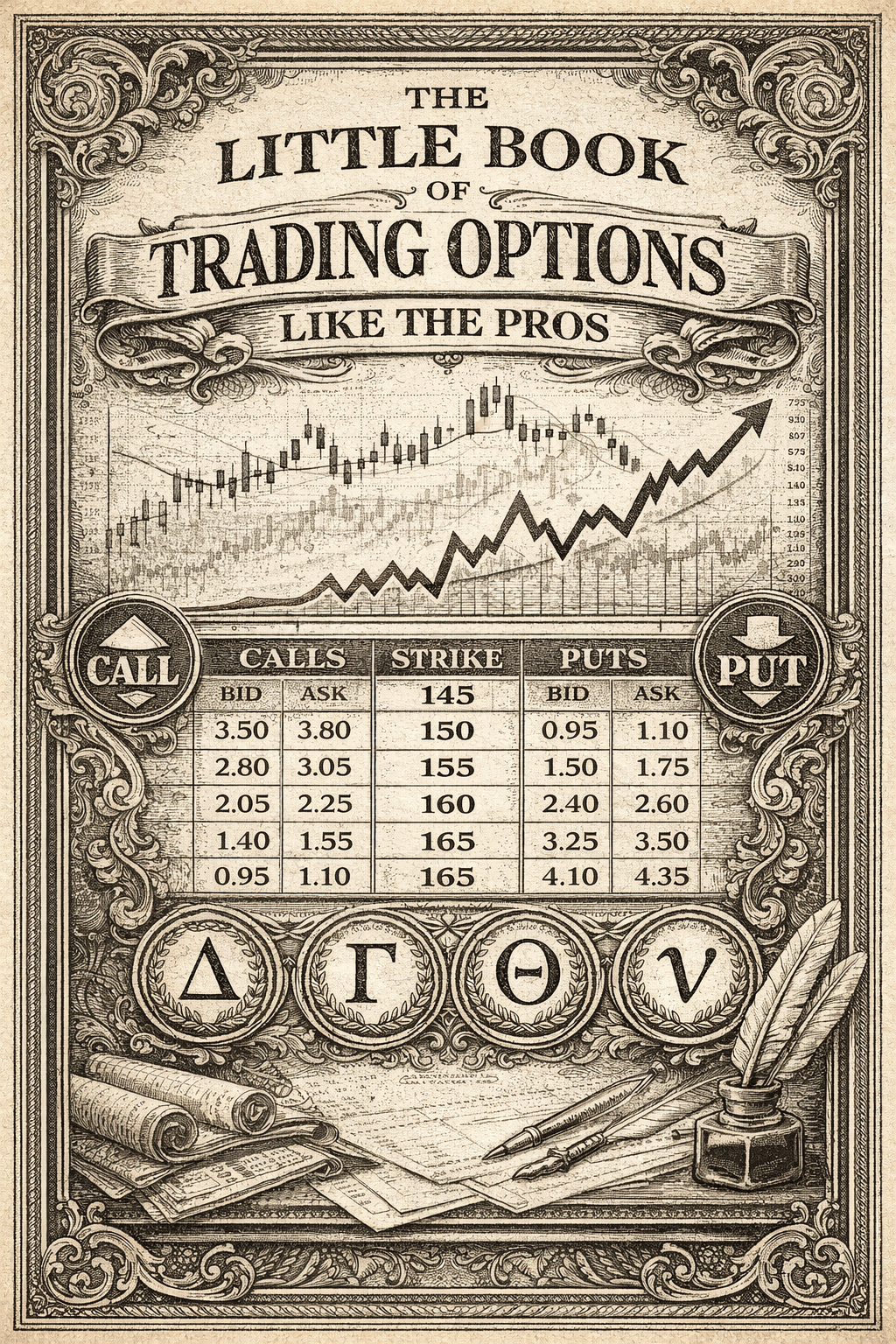

- The Fundamentals: Calls, Puts, and Why They Exist

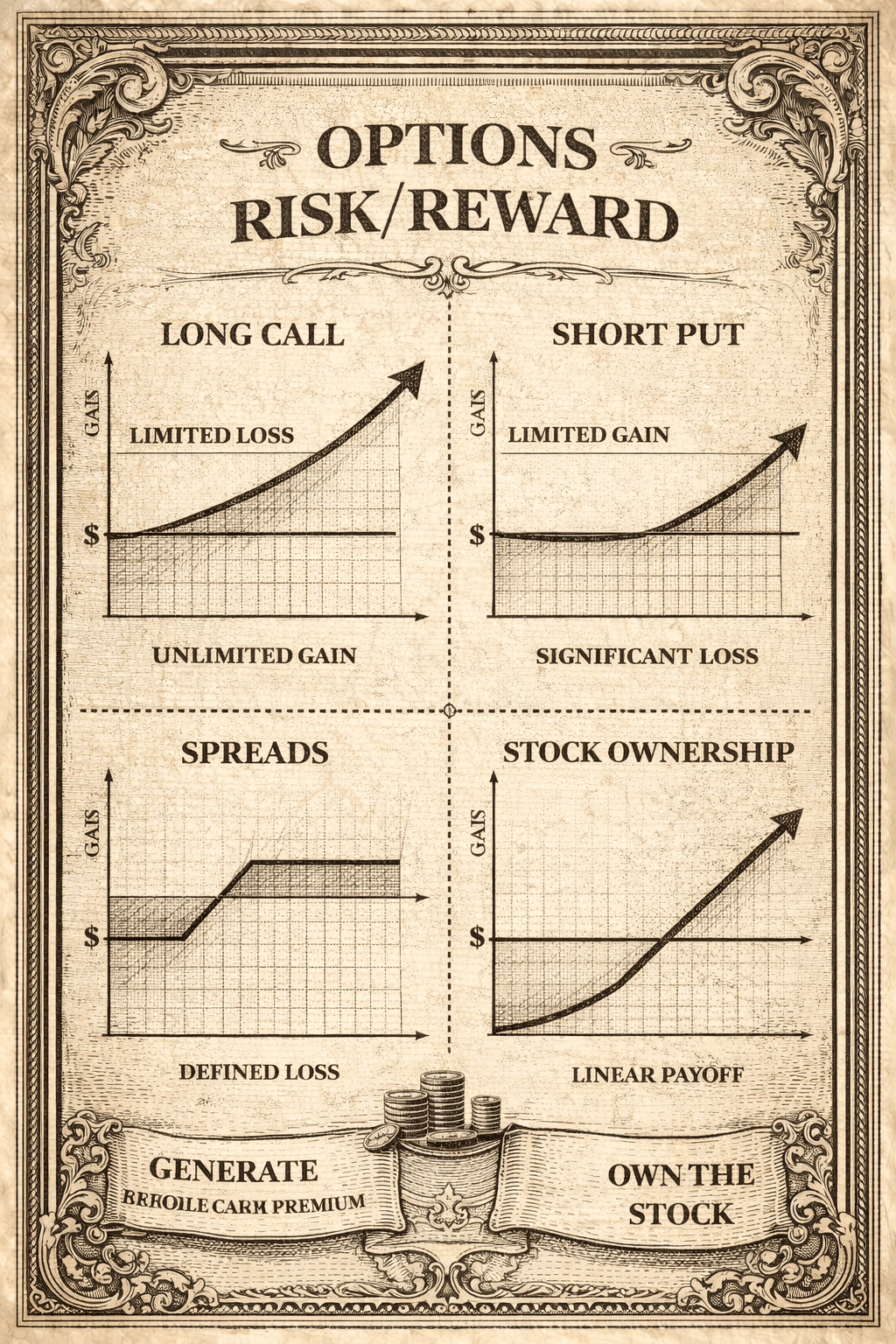

This section covers what options actually are. Contracts giving you the right (not obligation) to buy or sell stock at a specific price by a specific date. Calls give you the right to buy. Puts give you the right to sell.

The key insight here is that options are wasting assets. Unlike stocks, they have expiration dates. Every day that passes, your option loses value (theta decay) unless the stock moves enough in your direction to compensate. This is the single most important concept beginners miss.

Key insight: Many traders learn this lesson the hard way. Being right about a stock's direction isn't enough if you're wrong about timing and magnitude. Options are unforgiving about both. Understanding theta decay before placing your first trade can save you from expensive mistakes.

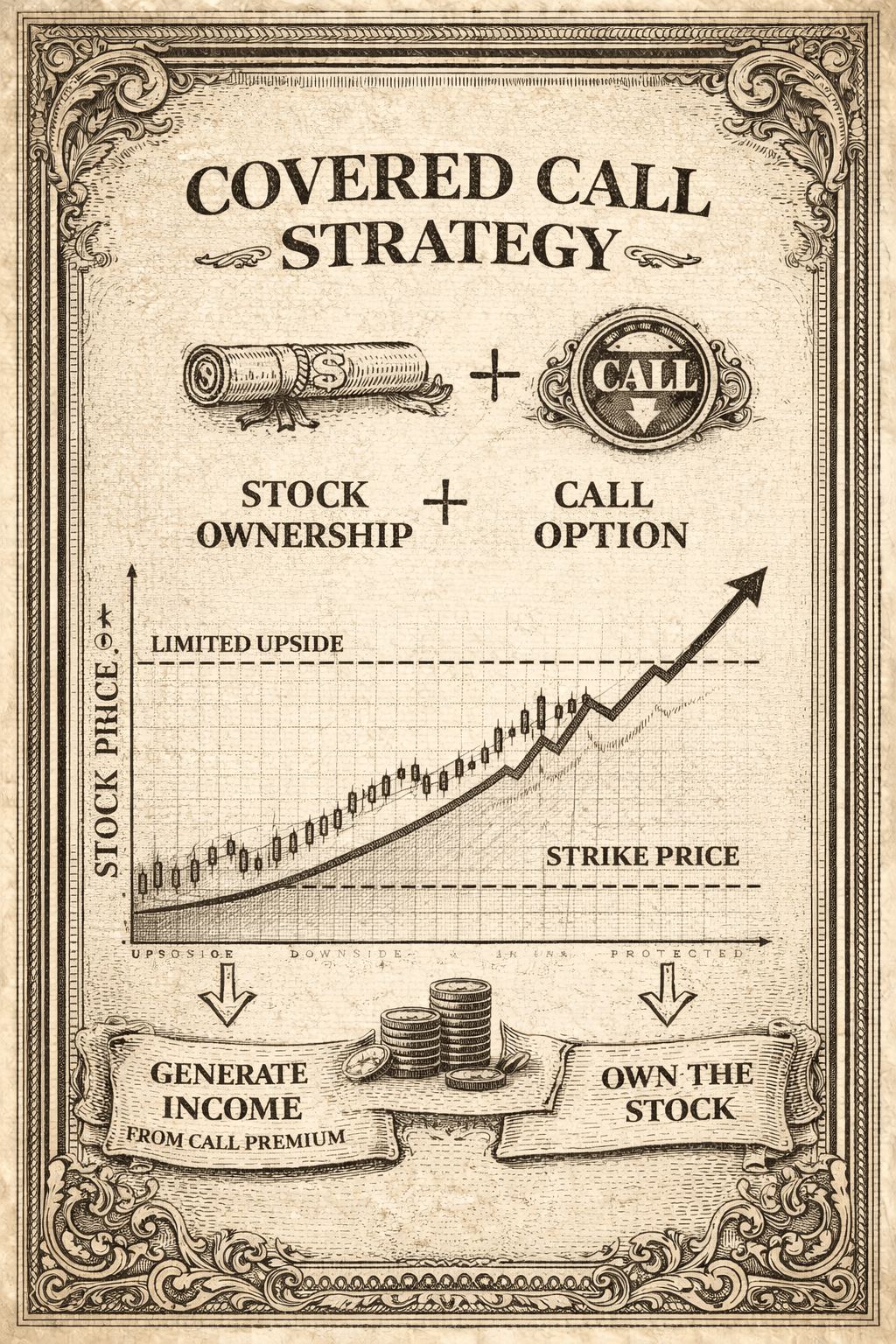

- Income Strategies: Covered Calls and Cash-Secured Puts

Here the book gets practical. Most professional traders don't buy options. They sell options to collect premium income.

Covered calls: You own 100 shares of stock, sell someone the right to buy them at a higher price. You keep the premium either way. If stock goes up past your strike, shares get "called away" but you still profit. If stock stays flat or drops a bit, you keep shares + premium.

Cash-secured puts: You want to buy stock at a lower price anyway. Sell a put at that price, collect premium. If stock drops, you buy at your target price (which you wanted). If it doesn't, you keep the premium for doing nothing.

Real-world application: This strategy is popular among income-focused investors who hold blue-chip stocks long-term. The typical approach generates 1-2% monthly income while capping some upside, a trade-off that makes sense if you're prioritizing steady cash flow over maximum growth potential.

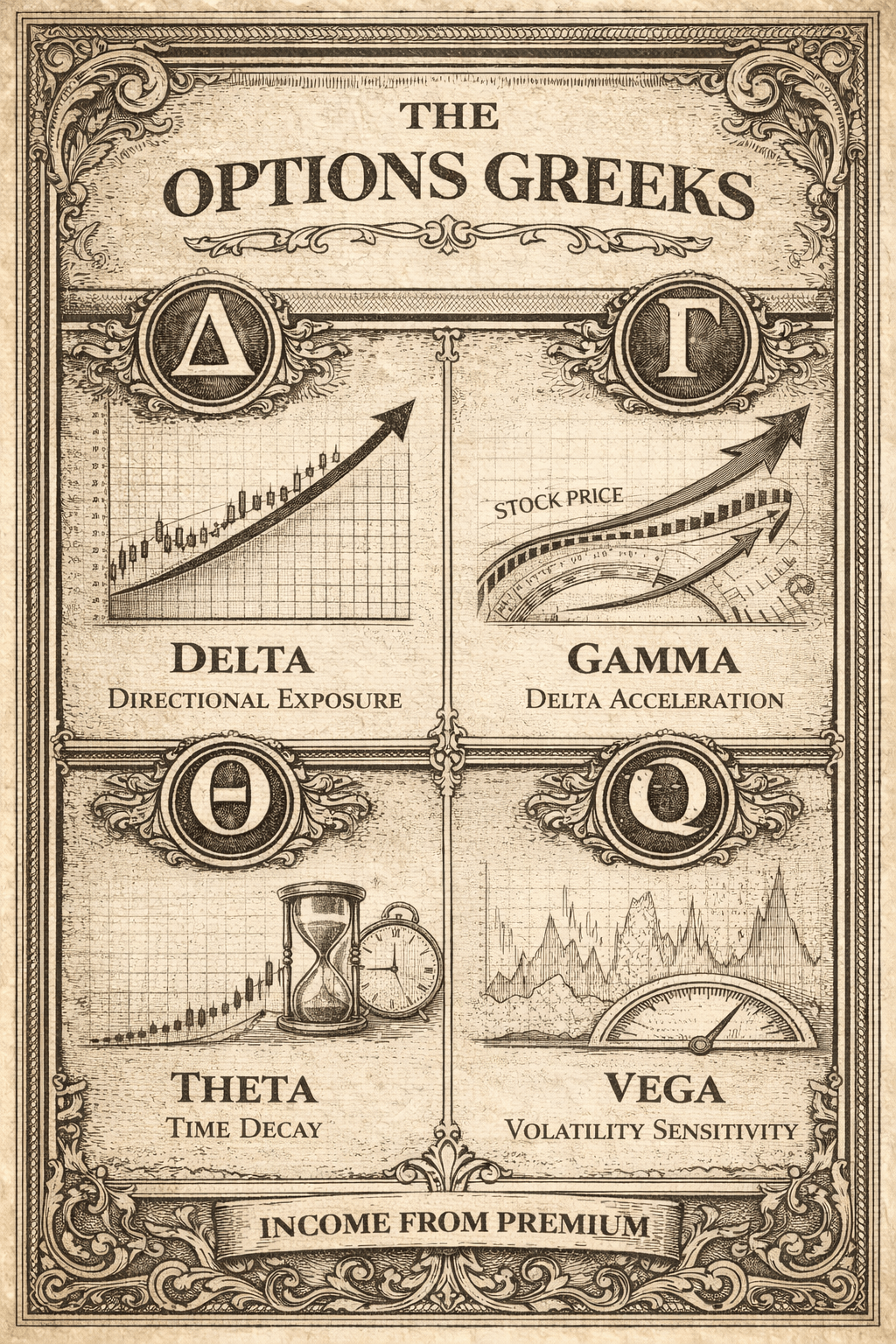

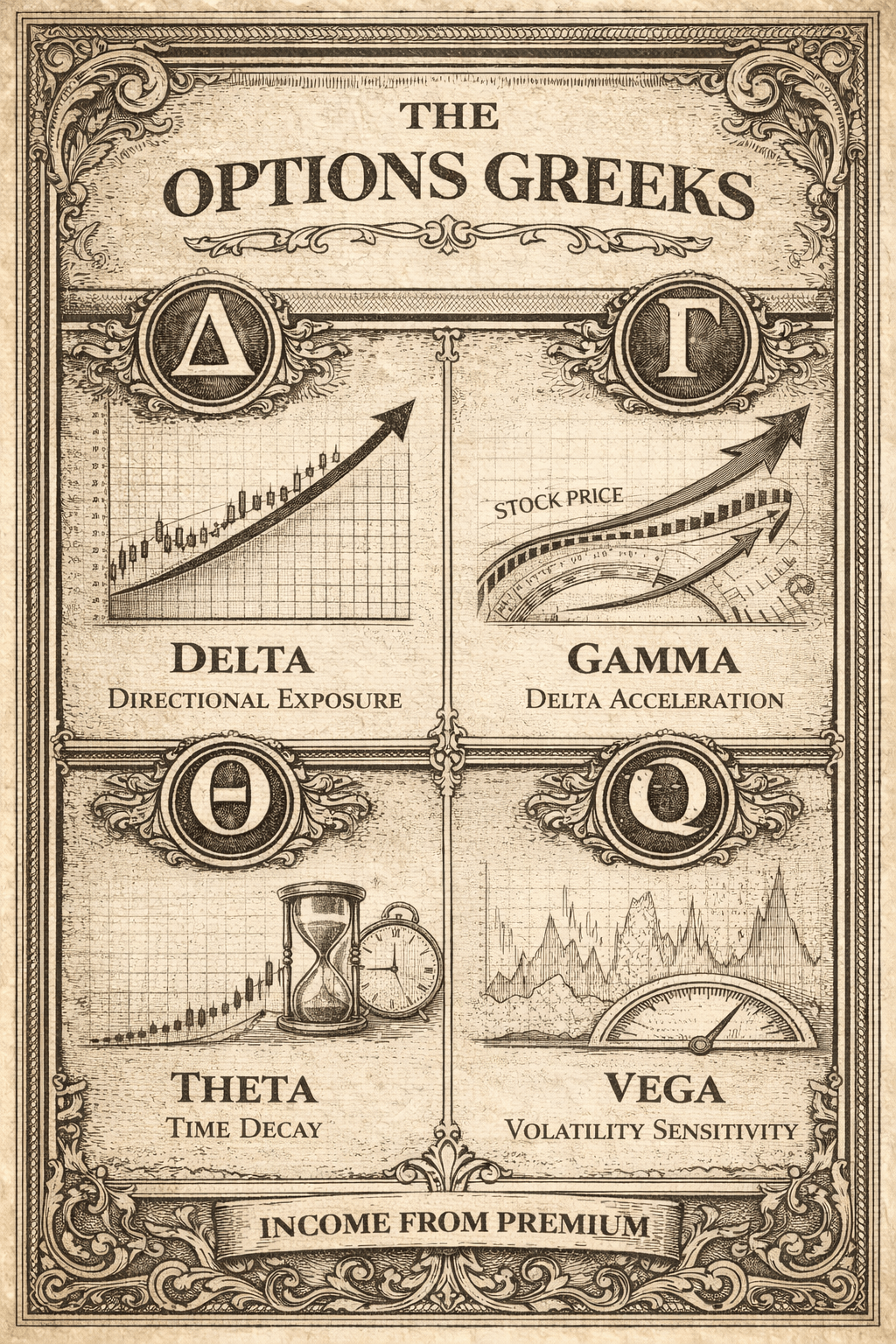

- The Greeks: Delta, Gamma, Theta, Vega

This is where most books either get too mathematical or wave their hands and say "don't worry about it." This book finds a middle ground. Explains what each Greek measures without requiring calculus.

- Delta: How much option price changes per $1 stock move

- Gamma: How much delta changes (acceleration of price movement)

- Theta: How much option loses per day (time decay)

- Vega: How much option price changes with volatility changes

The practical implication: you need to understand these to avoid getting blindsided. Buying options means fighting theta and needing big delta moves. Selling options means collecting theta but accepting delta risk.

Honest critique: The Greeks section is the densest part of the book. You'll probably need to re-read it a few times and practice on paper trading before it clicks. But once it does, you'll understand why professional traders obsess over these metrics.

- Advanced Strategies: Spreads, Straddles, and Risk Management

The final section covers more sophisticated strategies like:

- Credit spreads: Selling an option and buying a further-out option to cap risk

- Iron condors: Betting on low volatility, defined risk on both sides

- Straddles/strangles: Betting on big moves without predicting direction

But the most valuable part of this section is the risk management framework. The author hammers home:

- Never risk more than 1-2% of portfolio on any single trade

- Always know your max loss before entering

- Have exit rules and stick to them

- If you can't explain the trade simply, don't make it

Why this matters: Options can create asymmetric risk. Small mistakes can blow up accounts. This book treats risk as seriously as returns. That separates it from the hype-driven alternatives.

Why This Book Is Relevant in 2026

Options trading has exploded in popularity thanks to commission-free brokers. Most retail traders still treat them like lottery tickets. This book teaches you to think like a casino owner, not a gambler. Collect small, consistent premiums rather than swinging for home runs.

With market volatility becoming the norm (AI disruption, geopolitical instability, Fed policy whiplash), understanding options is increasingly essential for:

- Portfolio protection: Buying puts as insurance during uncertain times

- Income generation: Selling covered calls on dividend stocks for double-digit yields

- Capital efficiency: Controlling large positions with small capital outlays

- Volatility trading: Profiting from market fear/greed cycles

The writing is clear and practical, though sometimes a bit dry. This isn't a page-turner; it's a reference manual you'll come back to before making trades. I keep my copy dog-eared next to my trading desk for exactly this reason.

Final Thoughts & Where to Buy

⭐ Rating: 4/5. A solid, practical introduction to options trading that respects your intelligence and your capital. Not flashy, but effective.

If you want to understand options beyond "stonks only go up" meme trading, or you're tired of watching YouTube traders who mysteriously never show their account statements, this book delivers real education at a reasonable price.

Who should skip this: Complete beginners (start with basic investing books first), or people looking for "get rich quick" promises (you'll be disappointed).

Who needs this: Anyone serious about adding options to their toolkit, generating income from existing holdings, or understanding what institutional traders are actually doing.

📖 Buy The Little Book of Trading: Options Like the Pros on Amazon

Pro tip: Read this book, then paper trade for at least a month before risking real money. Options are powerful tools, and like all power tools, you can hurt yourself if you don't know what you're doing. The book will teach you the mechanics; practice will teach you discipline.

Related Reading

For philosophical and practical context on options and risk, you might also enjoy:

- Antifragile by Nassim Taleb - The philosophical foundation for options as antifragile instruments

From the Journal:

Real-world applications of volatility trading and antifragile positioning:

- Decan 24: Building Systems That Outlive You - Designing a barbell strategy with stable core + convex tail

This post contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you. Thank you for supporting this blog!