Antifragile: Things That Gain from Disorder by Nassim Nicholas Taleb

Nassim Taleb's Antifragile isn't just another self-help book about resilience. It's a paradigm shift that challenges everything you think you know about risk, randomness, and thriving in chaos. Some things break under stress. Others survive. But antifragile things actually get stronger.

Beyond Resilience: When Chaos Makes You Stronger

Introduction: A Book That Changed How I Think About Everything

Nassim Taleb's Antifragile isn't just another self-help book about "bouncing back" or being resilient. It's a manifesto that introduces an entirely new concept: systems that don't merely survive stress but actively improve because of it. Reading this book felt less like consuming information and more like having my mental furniture rearranged. Sometimes violently.

Fair warning: Taleb is not for everyone. He's brilliant, arrogant, often repetitive, and occasionally insufferable. But damn if he isn't onto something profound. This is one of those books where you'll find yourself arguing with the author in your head, scribbling in margins, and then realizing three chapters later that he was right all along.

Here's what makes this book essential:

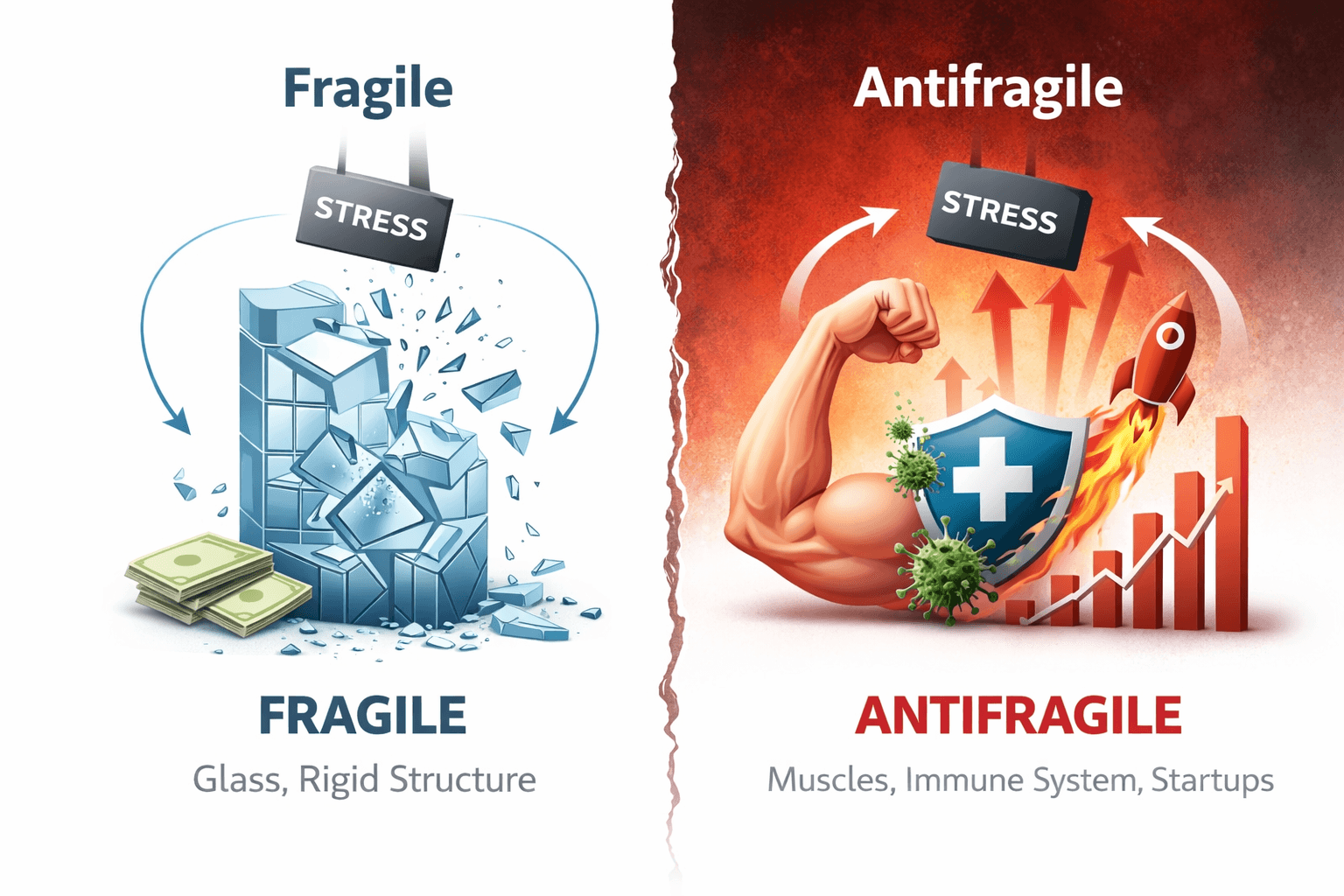

The Core Concept: Antifragility is beyond resilience. Fragile things break under stress. Robust things resist it. Antifragile things get better because of it. Think of your muscles after weightlifting, or startups that survive market crashes stronger than before.

Practical Philosophy: Unlike most philosophy books, this one is brutally practical. Taleb gives you frameworks for investing, career planning, health, and even parenting based on antifragile principles.

Intellectual Honesty: The book is filled with Taleb's academic feuds and personal vendettas, which is either charming or exhausting depending on your tolerance for intellectual combat. I found it mostly entertaining, though I did skim some of the more self-indulgent sections.

Timeless Wisdom: Written in 2012, yet feels even more relevant today. AI disruption, pandemic aftershocks, accelerating technological change. The principles of antifragility apply to everything from your investment portfolio to how we build AI systems.

For those who enjoy deep thinking about risk, complex systems, philosophy applied to real life, and don't mind a healthy dose of intellectual swagger, this book is essential. (Buy on Amazon)

Book Details at a Glance

| Feature | Details |

|---|---|

| Title | Antifragile: Things That Gain from Disorder |

| Author | Nassim Nicholas Taleb |

| Publication Year | 2012 |

| Genre | Philosophy, Business, Risk Management, Self-Improvement |

| Length | ~544 pages (but worth it) |

| Main Themes | Antifragility, Optionality, Via Negativa, Skin in the Game |

| Key Concept | Building systems that gain from volatility rather than being harmed by it |

| Relevance Today | Critical for understanding AI risk, market volatility, career resilience, health optimization |

| Readability | Dense but rewarding, conversational yet technical, occasionally meandering |

| Who Should Read? | Entrepreneurs, investors, risk-takers, systems thinkers, anyone building for the long term |

Breaking Down the Book: Key Themes & Insights

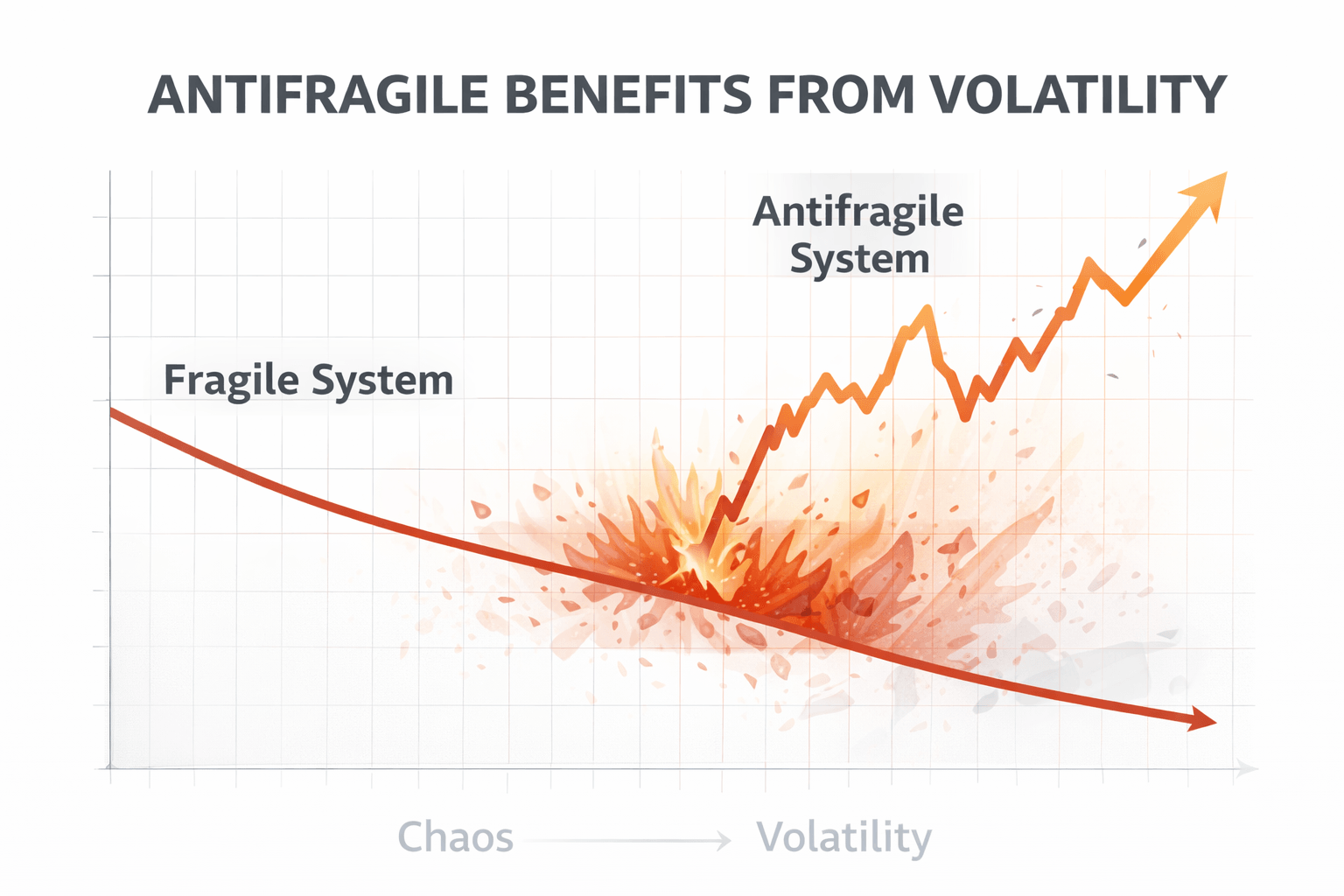

Taleb's central argument is deceptively simple: in a world of increasing complexity and unpredictability, we should build systems that benefit from randomness rather than trying to predict and control everything. The book is structured as a progression through increasingly abstract applications of this principle.

- Fragile, Robust, and Antifragile: The Triad

This is the foundational framework. A wine glass is fragile. Drop it and it shatters. A rock is robust. Drop it and nothing happens. But what's the opposite of fragile? Taleb argues it's not "resilient" or "robust." It's something that actually improves when stressed.

Your immune system is antifragile. Exposure to pathogens makes it stronger. Restaurants as a category are antifragile. Individual ones fail constantly, but the ecosystem improves through natural selection. Your portfolio can be antifragile if structured correctly.

The key insight: we have no word for this in English because we've been thinking about the problem wrong. We spend all our energy trying to make things robust, trying to reduce variance. We should be building antifragility instead. Building systems that benefit from variance.

Personal take: This reframed how I think about everything. My work: multiple income streams that benefit from chaos. My health: hormetic stress through fasting and exercise. My technology choices: simple, redundant systems over complex, optimized ones.

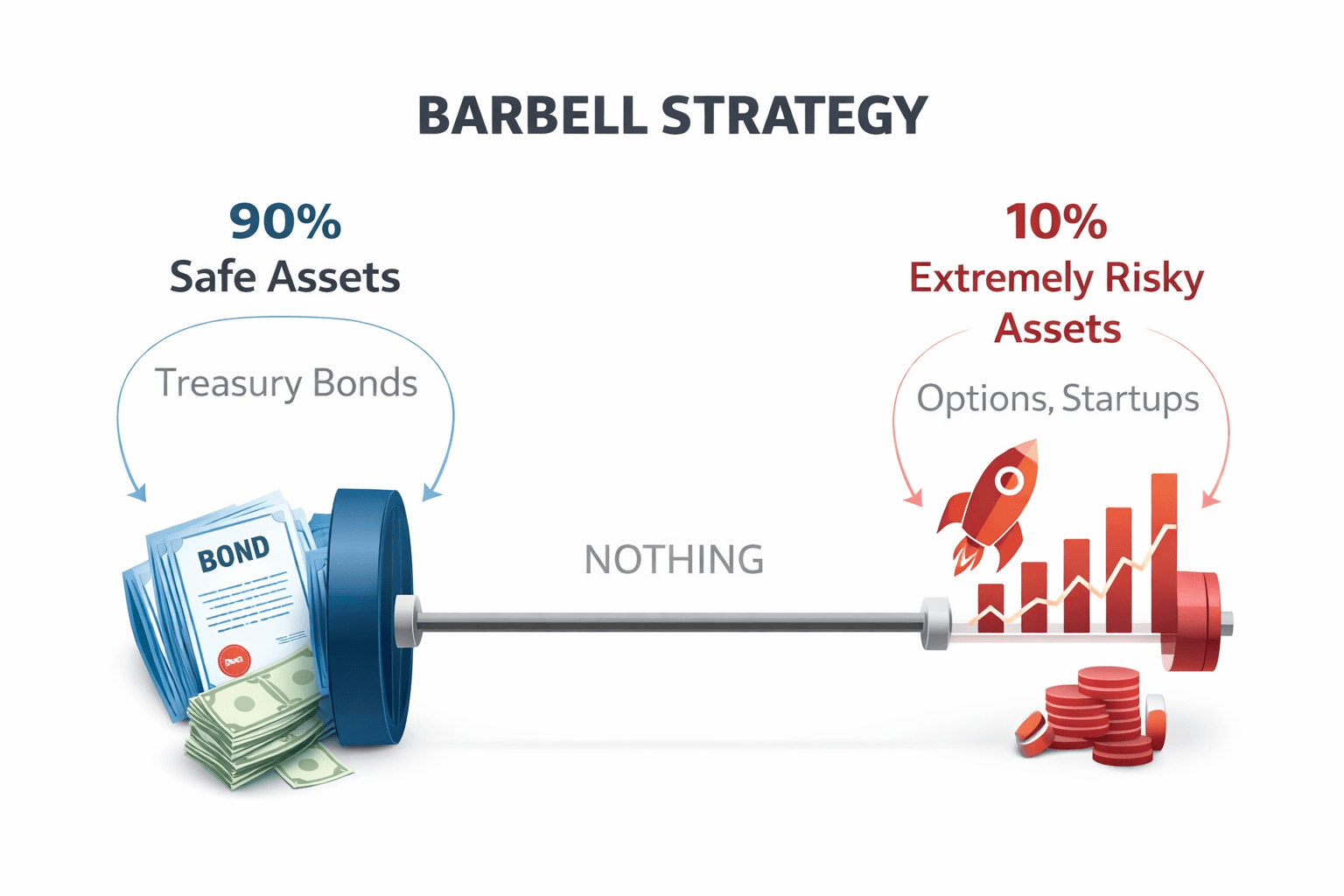

- The Barbell Strategy: Asymmetric Optionality

One of the most practical concepts in the book. Instead of taking medium risks, Taleb advocates for extreme bimodality. Put 90% of your resources in extremely safe, boring investments. Put 10% in highly speculative, high-upside bets.

This creates asymmetric optionality. You have limited downside: can't lose more than 10%. But you have unlimited upside: that 10% could multiply by 100x. The middle ground is where most people lose. Moderate risk with moderate returns, but vulnerable to Black Swan events.

Real-world application: This strategy can be applied to investments (safe index funds + speculative ventures), career planning (stable income + experimental projects), or skill development (deep expertise + broad exploration). The key insight is accepting that the speculative portion should be volatile—that's the entire point. You're protecting downside while maintaining upside potential.

- Via Negativa: Subtracting to Gain

Taleb makes a compelling case that we gain more from removing harmful things than from adding beneficial ones. This applies to diet: stop eating processed food before adding superfoods. Medicine: avoid iatrogenic harm before adding interventions. Investing: avoid stupid decisions before making brilliant ones. Life in general.

The medical establishment hates this chapter, which is probably a good sign. Taleb eviscerates the idea that we should constantly intervene, optimize, and "do something" when often the best action is strategic inaction.

Honest critique: This section gets preachy. Taleb beats the drum about medical harm for about 50 pages longer than necessary. Still, the core insight is solid. Remove fragility before adding antifragility.

- Skin in the Game: Asymmetric Risk-Reward

This might be Taleb's most important contribution to modern thought. He wrote a whole book about it later. The fundamental problem with modern society: the people making decisions often don't bear the consequences. Bankers get bonuses on upside but don't lose their houses when bets go wrong. Bureaucrats make rules they never have to follow. Intellectuals pontificate without risk.

Antifragile systems require that decision-makers have "skin in the game." They must share in both the benefits and the harms of their choices. Evolution works because bad genes die out. Markets work because bad companies fail. Democracy works, when it does, because leaders face consequences.

Why this matters in 2026: As we build AI systems and automated decision-making infrastructure, the question of who bears the risk becomes critical. An AI that makes medical decisions but has no stake in patient outcomes is fragile, dangerous design.

Why This Book Still Matters Today—More Than Ever

Written before COVID, before AI transformers, before the Everything Bubble. Yet Antifragile predicted the contours of our current moment with eerie precision. Taleb's framework helps us understand:

- Why centralized systems like supply chains and tech monopolies are vulnerable to Black Swans

- Why AI safety requires antifragile architectures, not "robust" ones

- Why the venture capital model works: barbell strategy in action

- Why your overoptimized life leaves you fragile to disruption

The writing is dense and Taleb's ego is substantial. But if you can tolerate his digressions, the insights are genuinely paradigm-shifting. This is one of maybe a dozen books I revisit annually because each read reveals new applications.

Fair warning: Don't read this if you want a quick self-help manual. This is a 544-page philosophical treatise dressed up as a business book. But if you're building systems meant to last, whether that's a company, a portfolio, a career, or your own life, the time investment pays exponential dividends.

Final Thoughts & Where to Buy

⭐ Rating: 4.5/5. A rare book that actually introduces a new concept to the world rather than repackaging old ideas. Taleb's arrogance is the tax you pay for genius.

If you think deeply about risk, design systems, invest money, or just want to understand why everything keeps breaking in surprising ways, this book is essential. Just keep a highlighter handy and don't be afraid to argue with the margins.

📖 Buy Antifragile: Things That Gain from Disorder on Amazon

Pro tip: Read this alongside Taleb's other books in the Incerto series: Fooled by Randomness, The Black Swan, Skin in the Game. For the full philosophical framework. But if you only read one, make it this one.

Related Reading

For more on applying antifragile principles to investing and trading, you might also enjoy:

From the Journal:

See how I applied antifragile principles in real-time during periods of maximum volatility:

- Decan 23: Blooming in the Desert - Reading this book during maximum life chaos and discovering hormetic stress

- Decan 24: Building Systems That Outlive You - Designing antifragile financial systems using the barbell strategy

- Decan 27: Sustained Warmth and the Alchemy of Small Frustrations - Antifragile alchemy: transmuting daily irritations into strength

This post contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you. Thank you for supporting this blog!